Dharamshala: At a time when several public sector banks in the country are facing a crisis of non performing assets (NPA), the Kangra Central Co-operative Bank (KCCB) that operates in 5 districts of Himachal Pradesh has reduced its NPA account from Rs 923.21 crore to Rs 834.23 crore by close of 2018-19 financial year.

Founded on 17th March, 1920, the cooperative bank is celebrating its centenary.

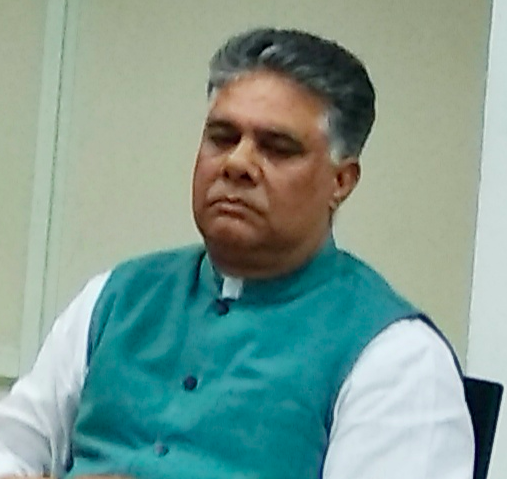

Speaking to Hill Post, Dr Rajiv Bhardwaj, chairman of KCCB said besides reducing the NPA by Rs 100 crore the bank has reported a profit of Rs 34.59 crore in FY 2018-19.

He said that the bank today launched some incentive schemes for its employees to further reduce the NPA account and to increase deposits so as to make it the top co- operative bank of India.

“Many new schemes for its customers will also be announced by chief minister Jai Ram Thakur at a centenary function that will be held at the bank headquarter here in Dharamshala,” Bhardwaj disclosed.

Talking about the schemes announced he said, “the bank has 6 type of branches, which are categorised by its deposits and advances that increase from Rs 10 crore to Rs 100 crores and incentive prizes have to be given for the best performing branches would be from Rs 75000 to Rs 2,75,000. The performance of branches would be judged from the target achieved in NPA recovery, loan disbursement, growth in digitalisation, profit, deposits etc. Under the scheme, for the second prize the remaining branches can win more prizes on other targets.

He added that there was a similar competition with cash prizes for all 18 AGM and the deadline for achieving the targets was 28th February, 2020.

Kangra Central Cooperative Bank operates only in 5 of the states 12 districts and is the 81st direct member Live on NFS that issues RuPay Cards. The Bank has even adopted ISO 20022 messaging standard format in NG-RTGS payment platform.

In 100 years the bank has opened 216 branches, 103 ATMs, has 13 extension counters spread over 18 Zonal Offices. The bank has a strong customer base of 25 lakhs.

Dr Bhardwaj said, “there were only 8-10 branches where the bank was not getting the required business. If required the branches could be shifted a few KMs to achieve the required targets.”

Arvind Sharma is an award winning bi-lingual journalist with more than 20 years of experience.

He has worked with Divya Himachal, Dainik Jagran, Dainik Bhasker, Vir Partap, Ajit and PTI.

In 2010, he was conferred the Himachal Kesri journalism award. He reports on the Tibetan Government in Exile, politics, sports, tourism and other topics. He lives in Dharamshala.