Himachal Pradesh Fiscal Responsibility and Budget Management (FRBM) Act was adopted in the year 2005 in consequence of the recommendations of the Twelfth Finance Commission. Himachal Pradesh was among the first few States to have accepted the need to have a State specific FRBM legislation.

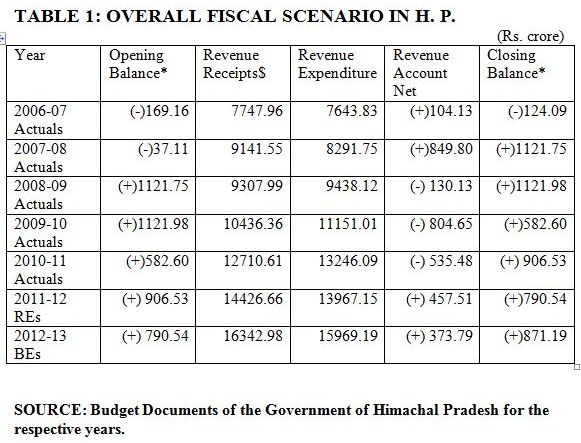

Since then, year after year, the Government has been tabling the Status report on the finances of the State in the Legislative Assembly. Comment on the fiscal situation will follow after we take a quick look at the overall position of the State Finances as exhibited in the following table:-

NOTES:

*: This is after taking into account the capital account, loans and advances, etc.

BEs stands for the Budget Estimates.

-

REs stands for the Revised Estimates.

-

$ : Revenue receipts include State’s own tax and non-tax revenues; the share in central taxes and revenue deficit grants from the Finance Commission dispensation; grant part of the central assistance for plan financing; and the grant part of the transfers on account of the centrally sponsored schemes channelized through the State budget.

The Government of Himachal Pradesh has been talking of a raw deal by the Thirteenth Finance Commission. We look at the figures for the last three years.

With the exception of 2010-11, the revenue account of the State Budget has had a huge surplus of Rs. 457.71 crore according to the revised estimates for 2011-12 and Rs. 373.79 crore according to the budget estimates for 2012-13, whereas the Thirteenth Finance Commission had just struck a balance on the revenue account.

If these numbers are correct which these should be as this is what has been presented to the Legislature and thus to the people, then the utterances about the Thirteenth Finance Commission giving a raw deal to the State of Himachal Pradesh are not founded on terra firma.

Secondly, the closing balance figures for each year show a surplus for the last several years despite the revenue account being in varying degrees of deficit for 2008-09 to 2010-11.

The overall closing balance being positive indicates that the State has been borrowing more and investing less in the capital account in building newer capital assets, thus improving the closing balance vis-à-vis the opening balance.

Any State which turns out a revenue account surplus consistently will automatically forfeit its right or claim for revenue deficit grants from the platform of the Finance Commission, provided such States have a revenue account surplus after transfer of the share in central taxes.

This precisely was the case for three special category States namely Assam, Sikkim and Uttarakhand who had a revenue account surplus post tax devolution for 2010-15 and therefore, did not get any revenue deficit grant from the Thirteenth Finance Commission for the said period.

It needs to be understood that the primary responsibility of the Finance Commission is to balance the revenue account of the total fiscal system of the country and by implication thereof, balance the revenue account of individual States of the Union.

The Commission does so by a design of the tax sharing and if gaps exist after the tax devolution, these are met by the revenue deficit grants. Whereas the tax sharing is a constitutional arrangement, the revenue deficit grants are more discretionary in nature.

Therefore, to say that a particular Finance Commission did not do justice to a particular State or States is uncalled for and exhibits lack of appreciation of the role of the Finance Commission.

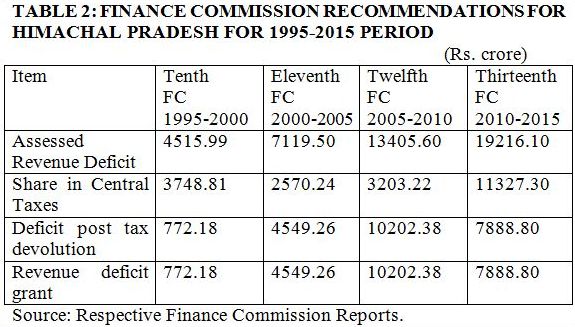

To appreciate this fact, it would be worthwhile to look at the transfers to the State of Himachal Pradesh through the recent Finance Commissions. The assessed revenue deficit gap was designated to be met in the following manner for the tenure of few previous commissions:-

The above data clearly reveals that irrespective of the quantum of transfers through the tax sharing design or the gap filling grants called the revenue deficit grants, the assessed revenue deficit has continued to be met in the successive Finance Commission awards.

As to the merit of the two streams of resource flow from the Centre to the States, one would always bat for the entire gap to be met by the tax sharing design rather than greater dependence on the mechanism of gap filling grants.

This is so because the tax devolution is a dynamic and buoyant situation whereas the gap filling revenue deficit grant is a static transfer. In that, the Thirteenth Finance Commission dispensation should be termed as the most progressive dispensation for Himachal Pradesh since 2000 AD.

However, one would hasten to add a comment that the question of the entire assessed revenue account gap being met through the tax sharing design for any particular State is not tenable as the tax devolution is formula driven.

If the formula share of a state exceeds the assessed revenue account gap – or the State becomes revenue account surplus after the tax devolution, there is no question of the revenue deficit grants being devolved to that State.

From the view point of individual States, it is eminently desirable to say that the assessed revenue deficit was inaccurate and did not meet the committed revenue expenditures of the State.

It is also desirable to say that the committed expenditures were under-assessed and the state’s own tax and non-tax revenues were over-assessed. But we all know that the proof of the pudding is in its eating.

Despite visible profligacy, the revenue account surplus for Himachal Pradesh for the years 2011-12 and 2012-13 narrates a different story.

These numbers reveal that the revenue account of the State has been more than balanced by the Thirteenth Finance Commission dispensation on one plane, and the State has exhibited great fiscal prudence in managing its finances, on the other, by becoming a revenue account surplus entity.

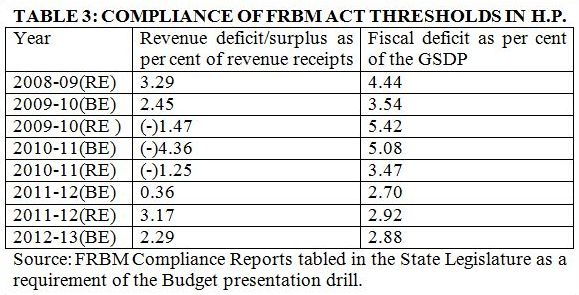

The State of Himachal Pradesh appears to be performing in a very satisfactory manner in so far as the bench mark parameters of fiscal discipline under the FRBM legislation are concerned.

The bench marks are that the State must achieve zero level of revenue account deficit and move towards a revenue account surplus on the one hand, and also contain the fiscal deficit to a level below 3 per cent of the gross state domestic product, on the other. The data for the last few years is presented in the following table:-

One does not need to comment on the years before 2010-11. There has been a significant improvement in the picture of the revenue account of the State.

According to the budget estimates for 2010-11, the revenue deficit of 4.36 per cent of the revenue receipts improved to a deficit level of 1.25 per cent according to the revised estimates for the same year.

The budget estimates of a nominal surplus of 0.36 per cent for 2011-12 improved to 3.17 per cent according to the revised estimates. The budget estimates for 2012-13 also show a revenue account surplus of 2.29 per cent of the revenue receipts.

This performance deserves to be lauded. On the fiscal deficit front, it has been declining from 2009-10 and it came well within the prescribed benchmark of 3 per cent of the gross state domestic product.

Thus, despite noises about the dispensation of the Thirteenth Finance Commission being unfair to Himachal Pradesh which do not appear to be based on facts, the State has acquitted itself well on the front of the fiscal responsibility and has been meeting the revenue surplus and fiscal deficit parameters required under the FRBM Act of Himachal Pradesh.

It will become known only after the presentation of the budget for 2013-14 whether the trend of Himachal Pradesh having complied with the FRBM Act prescriptions has continued or there has been any erosion in the scenario.

If the revised estimates for 2012-13 and the budget estimates for 2013-14 continue the trend of previous years for revenue account being surplus and the fiscal deficit being below 3 per cent of the gross State domestic product, it should be clearly understood that during the tenure of the Fourteenth Finance Commission (2015-2020), the tax sharing design will, ipso facto, more than take care of the revenue expenditure commitments and Himachal Pradesh will join the comity of the those special category States which did not receive any revenue deficit grant during 2010-15 period.

One could then say that Himachal Pradesh has come of age on the fiscal self-sufficiency front.

The author is a former Principal Adviser-cum-Secretary(Planning) to the Government of Himachal Pradesh.

Devinder Kumar Sharma, a former Principal Adviser and Secretary Planning, Government of Himachal Pradesh, is a visiting professor and an economist. He lives in Shimla.