Shimla: Number of lives lost to rash and negligent driving increasing each year in the hill state, the High Court here directed the transport authorities that from April it be made mandatory for all commercials vehicles to have tracking systems (GPS) installed on them.

The directions came from a division bench consisting of Justice Deepak Gupta and Justice Sanjay Karol while hearing civil writ petition.

For getting the directions implemented, the court constituted a high level committee to be chaired by the chief secretary that was asked to frame a scheme for the purpose.

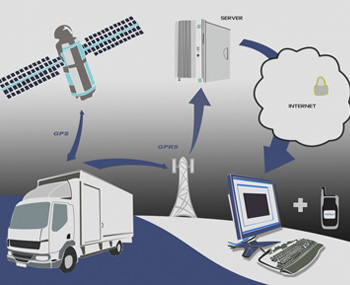

“Biggest culprits in regard to motor vehicle accidents are commercial vehicles especially those commonly referred to as utility vehicles and mini buses,” the judges observed before expressing the courts view that, “time has come when we must take the help of advanced technology to monitor the movement of vehicles. This will not only help in tackling the traffic problems but would be a great help in detection of crime, prevention of illegal activities and tracing out criminals.”

Benefits of GPS system are many and costs are small in comparison to benefits that could be derived from it, the judges declared.

In the same petition, the judges also pointed out that toll barriers put up at entry points to the state seemed to take one back to the dark ages as not only were they manually handled but road were blocked with help of ropes.

The judges noted that the contracts entered into with contractors for toll collection at these barriers there was a condition to have electronically – mechanically operated barriers, whereas none of the barriers in the state had the facility.

Before directing the transport authorities to ensure installation of electronic toll barriers, the judges noted that presently receipts given at these barriers were small printed slips, which would never enable the state to determine what amount the contractor actually earned.

“We are sure that huge amount of government revenue in the shape of taxes is swindled by either not issuing any receipt or issuing receipts which are an apology in the name of receipts,” the judges observed.

Before listing the case for January 10, the judges asked the committee to frame a scheme and give suggestions to the court on the matter.

As Editor, Ravinder Makhaik leads the team of media professionals at Hill Post.

In a career spanning over two decades through all formats of journalism in Electronic, Print and Online Media, he brings with him enough experience to steer this platform. He lives in Shimla.