Himachal To Raise Rs 1000 Crore Debt On 4 July, 2023

Held in a public debt trap and in dire straits to meet additional expenditure for reverting to an Old Pension Scheme, the Himachal Government has put out a notice for raising Rs 1000 Crores through state backed bonds by way of an auction to be carried out by Reserve Bank of India.

Of the Rs 1000 Crore to be raised, Rs 500 crore has a 10 year maturity period and the other Rs 500 crore matures after 15 years.

The auction will be conducted by the Mumbai office of RBI and it would be held on a yield based, multi price format system.

The minimal bond amount is Rs 10,000/- and investors, individual or institutional, can subscribe multiples of Rs 10,000/- securities.

Interested investors can bid for the securities by submitting their bids electronically on the Reserve Bank of India Core Banking Solution (E-Kuber) on 4th July, 2023 between 10.30 a.m. and 11.30 a.m.

However, the interested investor would have to express their expected yield percent (%) per annum up to two decimal points. More than one bid at different yields expected can be submitted.

The allotment would be displayed on the same day and successful bidders would have to make full payment by end of banking hours on 5th July.

Unable to meet its committed expenditure of salary, pensions and interest payments of public debt raised in earlier years, successive Himachal governments have been raising public debt to meet their current liabilities.

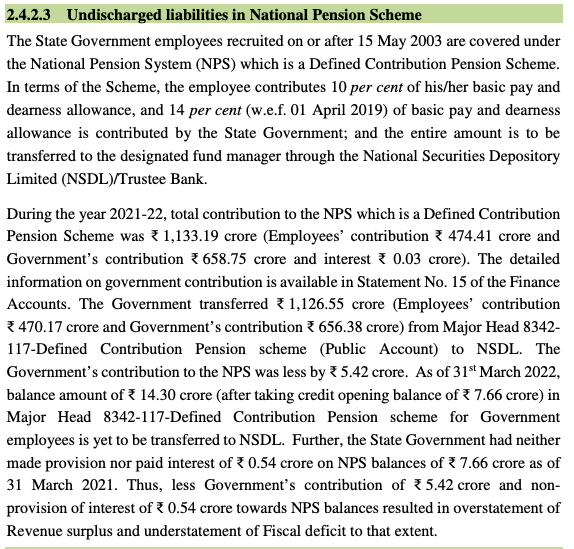

To reduce pension liabilities, a national pension scheme (NPS), launched on 15th May, 2003, was adopted by Himachal.

Ironically, it was the Congress Chief Minister Virbhadra Singh’s government that introduced NPS, when the Union Government was led by the NDA Government of Prime Minister Atal Bihari Vajpayee.

In fact, Himahcal was the first state in the country to take to NPS.

NPS – with contributory funding from the employee and employer, is designed to reduce state liabilities and increasing fund availability for meeting development needs towards other sections of society.

After almost two decades of implementing the contributory pension scheme, in the run up to the December 2022 assembly elections Himachal government employees expressed dissatisfaction with returns of NPS and vociferously raised a demand for reverting to the Old Pension Scheme (OPS).

Under OPS, the pension is fixed in accordance with the last pay drawn, but it also indexed to inflation and also increases whenever a new pay commission recommendations are implemented.

Himachal Chief Minister Sukhvinder Singh Sukhu, on assuming power in December 2022, announced implementation of OPS, which was a core election issue that had helped Congress to regain power in the hill state.

About 1.36 Lakh government employees become eligible for OPS but the government is also keen to extend it to employees of state government PSUs and Boards.

In office, the 6 month old Congress government has been complaining of a resource crunch and lamenting about the heavy debt burden the state is saddled with.

Industry minister Harshwardhan Chauhan even laid bare in early June that the state treasury was already in a Rs 1,000 Crore deficit.

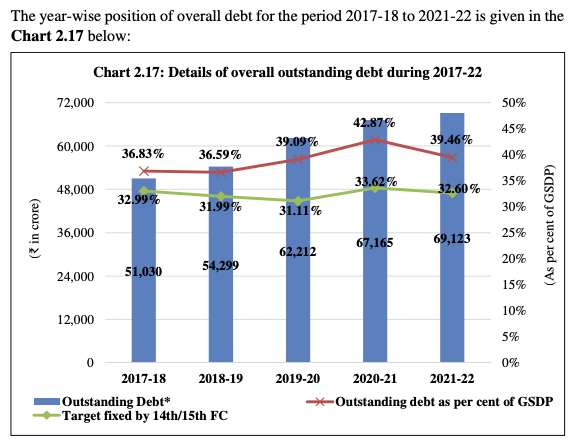

National auditor CAG in its 2021-22 report has recorded Himachal’s total outstanding liabilities at Rs 69,123 Crores.

Chief Minister Sukhu is making efforts to raise resources by improved excise collections after auctioning of liquor vends, calling for imposing water cess on hydropower generation, demanding increased royalties from hydropower plants that have become debt free.

The states GST revenues are also steadily rising, but all put together is not enough to meet the additional money needed to pay the OPS dues and arrears that the government has notified and has become effective from 1st April.

The state governments demand to reclaim the NPS amount that it has contributed towards the scheme over a 20 years period has been rejected by the Central Government, citing that there is no such provision under the scheme.

Meanwhile, to make ends meet, the government continues with its borrowing program; incrementally adding to the mountain of debt that state is reeling under.

As Editor, Ravinder Makhaik leads a team of media professionals at Hill Post.

Spanning a career of over two decades in mass communication, as a Documentary Filmmaker, TV journalist, Print Media journalist and with Online & Social Media, he brings with him a vast experience. He lives in Shimla.