Reserve Bank of India (RBI) has extended the deadline for the new Cheque Truncation System 2012(CTS-2012) to April 1, 2013, stretching the deadline by three months. Banks have been asked to stringently comply by the new guidelines by the revised date that was earlier put at December 31, 2012.

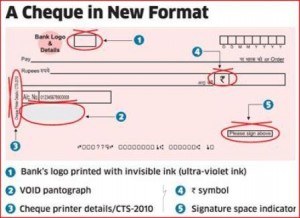

Cheque Truncation is the process of replacing the usage of physical cheques in the present banking system by an electronic image of the cheque that gets transmitted to the drawee branch by the clearing house (with all the relevant information including data on the MICR band, date of presentation of cheque and other details).

Approximately one billion cheques are processed in India annually and the plan will help in bring down cheque clearance time considerably.

The new guidelines are aimed at trimming down the cost and floating time involved in the movement and clearance of physical cheques, resulting in better service to the customers that would benefit the whole banking system in the country.

However, extension of the deadline will give some relief to bank customers who are still to switch over to being issued new cheques books that incorporate the all new prescribed standard features.

To discourage usage of standard cheques, a recent Reserve Bank of India circular to banks specified that the standard cheques (those that do not comply with the revised guidelines) presented before the clearing system after the extended deadline (March 2013) would be cleared at less frequent intervals and may also attract some clearing fee.

A mechanical engineering graduate with a post graduation in marketing and sales, Ashish has combined professional experience of more than 4 years.

Ashish is a great fan of Martin Scorsese. He loves to write poetry in his spare time.

He lives in Shimla.