Trends in expenditure 2008-09 to 2020-21 for Himachal Pradesh

For States like Himachal Pradesh, the analysis of the receipts does not present an interesting picture because a large bulk of receipts comes from central transfers. Also, there is little leeway in significantly improving the revenue receipts due to limitations on physical resources as also the tax base and tax rates on the one hand, and near closure of revenue harvesting from forestry and mining as also hydroelectricity, on the other. Given that situation, the only area where the State Government can make efforts to contain its budgetary stress is the area of expenditure. Even within the various areas of expenditure, as we go along, we will realise that the State Government is in a situation of complete helplessness.

The financial condition is so bad that the total revenues of the State do not even cover the expenditure on salaries and pensions. Historically, employment in the government sector is the most favoured engagement in the State and the employees’ unions hold considerable influence in determining the electoral outcome for the State assembly.

Expenditure items like salaries, wages, pensions and interest payments constitute committed expenditure and put together, these leave little space for upscaling the maintenance expenditure so vital for the health of the created physical infrastructure. Similarly, the capital expenditure on repayment of loans is also committed in nature and leaves lesser space for actual capital works to expand physical infrastructure.

Trends in revenue expenditure reveal that as a ratio of the total Gross State Domestic Product, it has gone up from 19.11 per cent in 2011-12 to 22.15 per cent in 2016-17 according to the revised estimates. The capital expenditure, on the other hand has gone up from 2.49 per cent to 3.26 per cent of the Gross State Domestic Product for the corresponding years. Expenditure on social services like education and health remains very low. Put together, these account for 5 to 6 per cent of the Gross State Domestic Product.

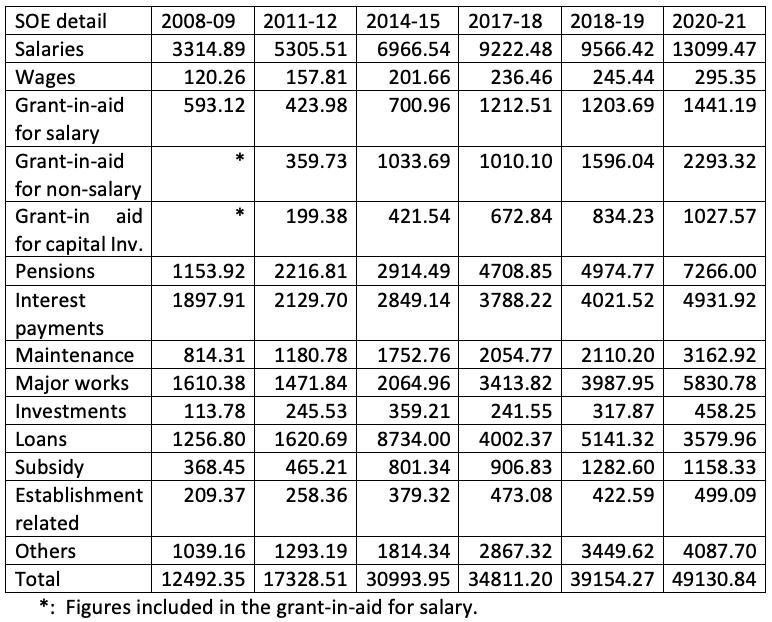

The data on major items of expenditure known as “Standard Objects of Expenditure” for the period 2008-09 to 2020-21 is tabulated in the following table. A quick look at the tile series data will reveal that there has been no shift in enhancing quality expenditure. The phenomenon of incrementalism in the major lumps of objects of expenditure is clearly visible. The data for all the years except the year 2020-21 is the actuals whereas for 2020-21, it is the budget estimates.

Table 1: Standard Objects of Expenditure in (Rs. crore)

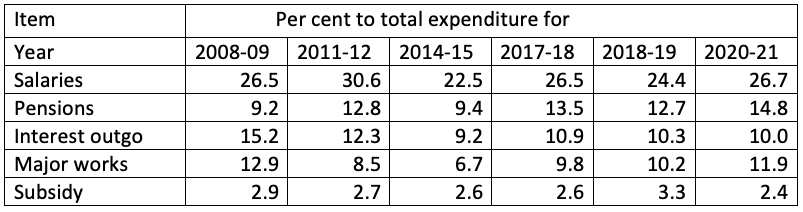

Table 2: Converted into percentages, the above major expenditure items show the following trend over time:

It can be seen that salaries, pensions and interest payments constitute the three prime objects of expenditure other than the loans. In a mountainous State like Himachal Pradesh with vast geographical area, rugged topography, natural barriers and sparse population, making the administration reach the remote corners and providing for the essential social services towards improving the social and human capital calls for a tall order of financial and physical resources. Given this consideration, it is inherent that the expenditure on administration which is largely reflected in the salary bill of the State will be much higher than the normative prescriptions for the plain areas or States.

Although the expenditure on salaries has increased considerably over the study period in absolute numbers, yet what is heartening is that with the exception of 2011-12 when it constituted 30.6 per cent of the aggregate expenditure, it has ranged around 25-26 per cent of the total. This, however, is slightly deceptive because a certain part of the grant-in-aid is linked to the disbursement of salaries of such workers which are not regular government employees but are on some form of contractual engagement. If this is added to the salaries component for the year 2020-21, the expenditure share will rise close to 30 percent. Bringing it down is a herculean task because the existing field formations and infrastructural institutions cannot be shut or allowed to become dysfunctional.

Talking of the expenditure on pensions, it has drastically risen from 9.2 per cent in 2008-09 to 14.8 per cent for 2020-21. This is attributable to the bunching of retirements, increased longevity and enhanced pensions.

For 2020-21, the budget figures indicate that the salary and pension-related expenditure would be in the proximity of 45 percent of the total expenditure. There is no way the State Government could compress or reduce this expenditure even in a long time frame. This is a worrisome scenario.

The expenditure on interest payments has shown some degree of stability and decline. This should not be misunderstood as fiscal prudence on the part of the State Government. Actually, the interest rates have softened and the FRBM cap on fiscal deficit prohibits the State Governments from reckless borrowings to fuel its unproductive revenue expenditure. The current trend of restrained growth in the interest outgo is likely to continue given a more stringent regime recommended by the Fifteenth Finance Commission.

The investments in major works have not shown the required or desired growth not because the State Government would not like to do so, but because of the overbearing pressure of mounting revenue expenditure which is more in the nature of consumption expenditure rather than asset formation or enhancing the quality of delivery and content of social services which add to human capital.

In many States the expenditure on subsidies largely in the nature of unproductive doles has grown at an alarming rate. On the contrary, the outgo on subsidies in Himachal Pradesh has been well contained. Subsidy on domestic consumption of electricity is the major lump but in the local context, it should legitimately qualify to be a merit subsidy. The other major subsidy is on essential commodities like pulses, cooking oil, etc. also augurs well for containing the increase in prices keeping in view the fact that Himachal Pradesh is a terminal State in the line of consumption.

The above expenditure analysis should be looked at in the context of FRBM parameters. The revenue account compliance of the FRBM Act demands that the State should have a zero revenue deficit. In the first ten years of the implementation of the FRBM legislation, the State has defaulted to the prescribed benchmark five times. One could go into examining the details of this erosion but as it happens historically with most of the revenue deficit (own revenues account) the Special Category States, the last years of a finance commission dispensation tend to be of greater fiscal stress. For the 2010-15 period (the 13th Finance Commission award tenure), the revenue surplus of the first two years turned into a deficit for the last three years. A similar story will hold true for the successive Finance Commissions. Although it can be said that the State has been complying with the revenue account threshold for the purposes of FRBM Act over the recent years, yet it is likely to end up with a revenue deficit in the closing year of the Fourteenth Finance Commission award i.e., 2019-20 when the actuals become available. Could one say that the balancing act done by the Finance Commission was a bit removed from reality? As always, the mounting salary and pension expenditure and interest payments due to increasing debt stock would be the prime reasons for the erosion of the revenue account.

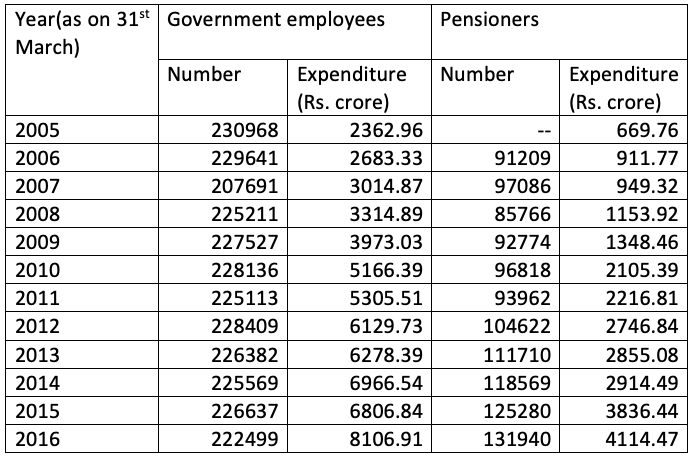

Talking of expenditure on salaries and pensions again, it will be of interest to look at the time series data on the total number of employees and pensioners in Himachal Pradesh which is presented in the table.

Table 3: Data on government employees and pensioners

It may be seen that the total number of government employees (other than the employees of the public undertakings and the local government institutions) has not increased from the 2005 level in any year. In fact, the number of employees has come down by about 6000 for the year 2016. This trend will hold likely into the future because the institutional expansion for socio-economic infrastructure has reached saturation levels and is now in the consolidation phase. Similarly, there is a limited likelihood of expansion and additional employment in the regulatory functions and law and order enforcement machinery. Because of these assumptions, the incremental expenditure on salaries will largely come from the pay revisions and the additional dearness allowance burden. This is a committed expenditure and any unrealistic normative prescriptions for its future management or projections will only lead to severe financial stress on the State’s resources and its capacity to adhere to the FRBM Act parameters will also be severely hampered. Another way of looking at the salary expenditure is the per capita cost. For the year 2005-06, per employee cost was about Rs. 1.14 lakh which increased to about Rs. 4.33 lakh for the year 2015-16. The big impact of the last pay revision came in the year 2009-10 after which it has seen the normal growth pattern as exhibited by the data in the above table. A similar story holds true for the pension burden. Its full-scale impact came in the year 2010-11 due to a certain time lag in the implementation process vis-à-vis the serving government employees. Data for the years 2010-11 and 2011-12 should be used for forecasting the salary and pension burden for the future. Simultaneously, the possible impact of the next pay revision should also be factored into the expenditure forecast for the future. Regarding the pensioners, it needs to be appreciated that with continuous increase in the life expectancy, their number is likely to see sustained growth in the years to come. The data above shows that the number of pensioners has gone up from 91,209 in 2006 to 1,31,940 in 2016 indicating about 4.5 percent simple annual growth rate. The per pensioner burden was of the order of about Rs. 1 lakh in 2005-06 and it increased to Rs. 3.12 lakh for 2015-16. It is implicit that the pension burden will continue to increase for some time to come till all the employees recruited before May, 2003 retire and future retirements will have no burden on the public exchequer on the one hand, and natural mortality rate will reduce the number of old pensioners gradually, on the other.

These two major liabilities on the revenue expenditure account need to be very carefully assessed by the State Government for presentation to the future Finance Commissions as these cannot be taken care of by any kind of normative prescriptions handed down by the Central Finance Commissions. Reduction in the number of employees – both regular and contractual, will be too draconian a measure for any popularly elected government in the State and can lead to change of the government at the hustings.

Having made the above comment on the salary expenditure, it is important that the efforts undertaken by the State Government for containing the salary expenditure are put together. The State Government has adopted the policy of hiring the essential employees on contractual basis in several areas, which has resulted in savings in expenditure on salaries in the immediate context. In four major categories of employees, namely clerks, JBT and PAT (teachers for primary schools), TGT and C&V teachers for middle schools and high schools and doctors, the total number of employees hired on contract comes to 10,550 and the annual saving on this arrangement as compared to the regular employment at the start of the pay scale comes to Rs.199.57 crore. It may also be noted that this is an illustrative number and not exhaustive number. The actual savings will, therefore, be in excess of Rs. 200 crore per annum. The number of such employees at an overall level is about 5 percent of the total employment of the State Government. There is, however, a catch in the scheme. These contractual employees keep becoming eligible to be regularised after a specified period of service which tenure has kept getting smaller as the unionisation of these cadres occurs and the fact that all of these are functional positions in nature. Savings today would mean higher expenditure in the very near future. The State government is in a state of bind on these counts. Chances of growth in revenue receipts, to meet these liabilities are bleak and it is imminent that the State Government increasingly takes recourse to farming out certain activities which can be done efficiently by the private sector at relatively lower costs. One specific area which should deserve special attention of the State Government is the effective operation and maintenance of the existing physical infrastructure towards providing better services.

The components of the expenditure scenario offer little elbow room to the State Government towards cutting down expenditure without adversely impacting the quality of infrastructure. Expansion in the number of field formations in the departments like public works, irrigation and public health, education, health, veterinary services will not only attract more salary expenditure but will also severely hamper the quality of delivery of services. Rationalisation based on hard data about field formation-wise could enhance resource use efficiency and user satisfaction and happiness. Information technology tools can enhance efficiency at large and productivity of the employees by pin-pointed responsibility at a relatively lower cost as the density of penetration of connectivity, speed of data transmission and the cost of mobile telephones and cost of their use keeps improving. Most solutions mentioned here are bitter pills to swallow but someone someday will have to bite the bullet in the larger public interest and towards achieving larger public good.

An increase in expenditure can also be met by raising more resources. To mention briefly, the potential for raising resources domestically by Himachal Pradesh is severely limited. As has happened in the past, the State has all along leaned on heavily on central largesse and any squeeze against the local aspirations on this count by the Centre will hurt the quality of services. With passing times, the transparency about the transfer of financial resources from Centre to States has been increasing with the space for the element of discretion with the Centre becoming progressively smaller. The revenues and expenditure are like east and west, conventionally opposite to each other. And to quote the famous poem by Rudyard Kipling, “East is east, and west is west, and never the twain shall meet”.

*****

Devinder Kumar Sharma, a former Principal Adviser and Secretary Planning, Government of Himachal Pradesh, is a visiting professor and an economist. He lives in Shimla.